What “Qualified” credit card processing rates really mean…

Your Processor playing the shell game with your money?

How do you even know when statements are so confusing, right?

There are only a few major pricing models to understand in merchant services:

- Cost Plus

- Tiered

- Bill Back

Read our discussion of these methods below to see how you’re being charged and to gain a true understanding of your processing costs. With this knowledge you’ll be able to determine if you’re with the right merchant services partner.

Commoditized Merchant Services….

Don’t play the shell game with your payment processing.

Cognitive Business Technologies only uses “cost plus” pricing for all of its payment processing, which guarantees you get the best possible pricing on every card transaction so you’re not left guessing.

Standard rates are 0.30% or less based on your average monthly processing volume.

Lower rates for large volume merchants. Free EMV/NFC/ApplePay processing equipment.

Pricing methodologies for Payment Processing

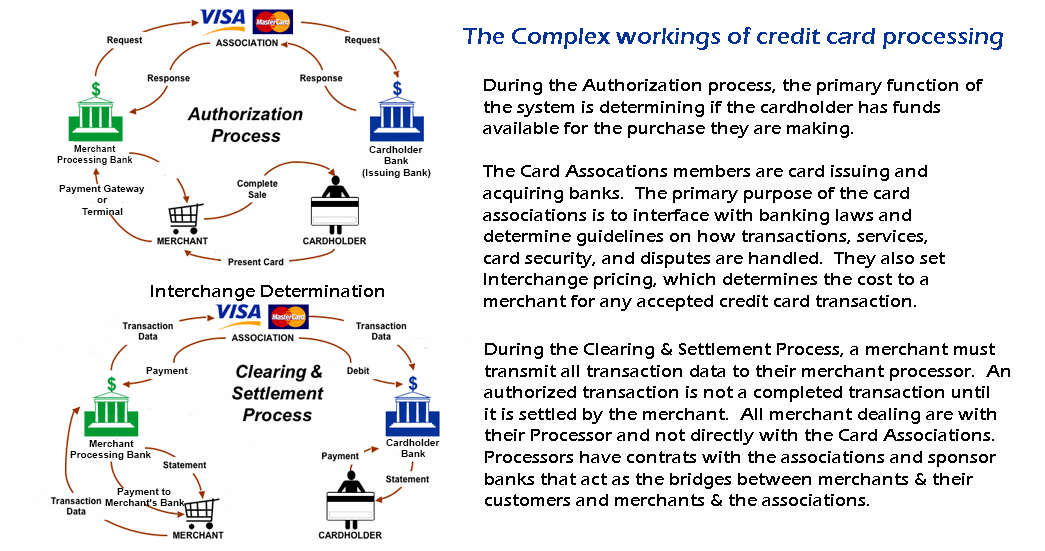

How does payment processing work?

Interchange… and why it’s the most important part of the puzzle.

If you’ve been in business for any length of time, you’ve undoubtly had someone call you or stop by your business to explain to you how they are Visa & MasterCard “wholesalers” or that they have the lowest “Qualified” rates, although they may leave out the word qualified. Well the interchange system shows both of these to be lies.

Interchange is a system of discount rates and transaction fees that are set by the Card Associations (Visa, MasterCard & Discover) and American Express. These interchange fees are based on card type and under what circumstances they are used. Card type isn’t the brand (Visa, MasterCard, Discover, or American Express), nor the card issuing bank (Citi, Chase, Captial One, etc), but rather more broadly it refers to debit, check card, credit, rewards, purchasing, etc. Transaction type is broadly defined by how it was used; such as, swiped, keyed, e-commerce, etc.

There are currently about 300 separate interchange fees based on various combinations of these card and transaction types. Recently regulation from Washington has also affected some of these fees.

The most important part of knowing about interchange is the knowledge that every processor is subject to the same exact fees. There are no wholesale rates for any processors and the Card Associations do not recognize nor regulate any processor’s “Qualified”, “Mid-Qualified”, “Partial Qualified”, or “Non-Qualified” tier values.

Interchange fees do not include other fees from the associations, such as dues & assessments; nor do they include fees by the other entities involved in processing card transactions, such as your processor, their sponsor bank, payment gateway companies, PCI security companies, authorization and settlement companies. That being said, Interchange fees do make up approximately 80% of a fairly priced card processing service.

Use these page links to view current Interchange fees:

The 3 Primary Methods of Pricing…

Cost Plus Pricing Model

Also called Interchange Pass-thru. This pricing model is the only model that will allow you to compare processing companies since all processing companies pay the same base fees. Straight forward in the sense that you will pay the interchange cost and associated pass-thru fees on any given transaction plus a defined mark up of the transaction.

Processor Margin:

with assumed Mark up of 0.30% (30 basis points):

- if your total processing volume for the month is $10,000, processor will make $30 profit.

Pros:

- straight forward, transparent pricing with generally the lowest costs for processing.

- generally guarantees processor will get you the best interchange qualifications.

Cons:

- your statements may be a bit confusing until your agent shows you how to read them.

Tiered Pricing

Available generally as 2-tiers, 3-tiers, or 4-tiers. This pricing model is the easiest for most merchants to understand as it seems straight forward with only 2, 3. or 4 qualification levels to be charged at. The problem with tiered programs is that with over 300 interchange fee levels, what is your card going to qualify as since the Card Associations do not recognize the terms “Qualified” or any of the other tier level terms. Every processor can set their own mix of Interchange fees in any given tier and furthermore, they can change that mix at any time they so choose. Meaning that a card you accept today that is “qualified”, may be considered “non-qualified” tomorrow. This method is the shell game of credit card processing as you have no verifible method of determining your actual costs.

Tiered pricing does have its place in the industry though when it is used for aggregating small merchants with a limited number of transactions. “Micro-Merchants” may actually see a lower effective rate in an aggregated merchant account then they would see with a full merchant account since they would not be subjected to all the ancillary fees attached to a full merchant account. “Micro-Merchants” are generally classified as accounts processing less than $2500 monthly. Aggregated merchant accounts are used frequently to add services without the need to change your primary merchant account.

Processor Margin:

- with no defined methodology to determine actual fees paid, it is impossible to determine your processor’s margin.

Pros:

- Statements are generally easy to read.

- Aggregated accounts allow merchants to easily add ancillary services.

Cons:

- Impossible to determine if you have good pricing or not.

- Tier mixtures change regularly to increase processor profits and merchant costs.

- Changes in interchange cause dis-proportionate fee increases in tiers pricing.

Bill Back (Enhanced Bill Back, Rate Recovery, Enhanced Rate Recovery)

A method of billing a transaction over the course of upto 3 months. This pricing model is the most difficult for merchants to understand as there is no straight forward way to actually explain what is happening. In General, a merchant is given a rate or set of rates that they will be charged the month of the transaction. The will also be given rates that will be charged to some or all of the cards during the ensuing month or two. The secondary rates that are billed on ensuing months will not match any of the transactions on your statement and make it impossible to calculate your monthly costs for card processing. We have yet to see this method used for anything helpful to a merchant.

Processor Margin:

- Impossilbe to calculate for any merchant or any processing agent.

Pros:

- None.

Cons:

- You’ll lose sleep thinking about it.